A Challenging, But Stable Market

The past few years have been challenging for both businesses and the insurance industry. After years of stability, a confluence of factors have led insurance companies to reevaluate their positions in the market. The increased frequency and severity of claims, social inflation, the COVID-19 pandemic, medical inflation, trends in cybercrime, the cost of reinsurance, natural disasters and investment returns have all fundamentally reshaped the insurance market as we know it.

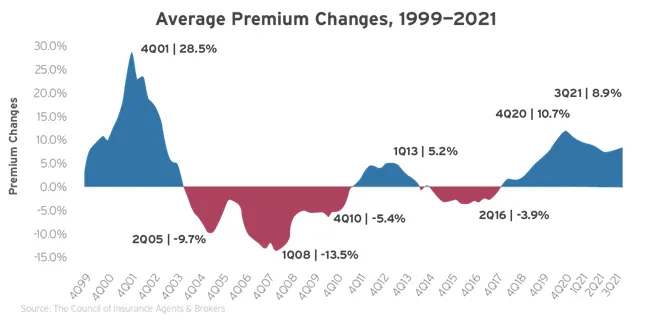

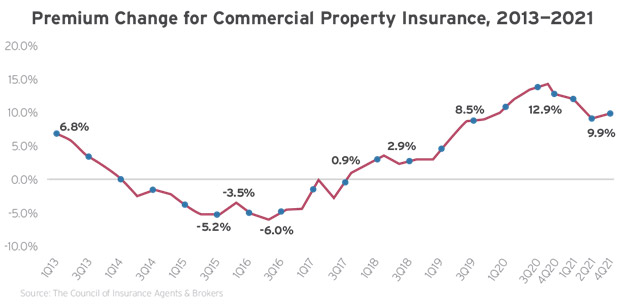

Like many other sectors of the economy, the commercial insurance industry experienced further changes to both its market cycles and its operating procedures. In particular, 2021 once again accelerated a hardening insurance marketplace—one that is less friendly to insurance buyers—which is now nearly two years old. For many, lines of insurance capacity left the market, reinsurance became more expensive, underwriting got stricter and—most importantly—premiums continued to rise.

What’s more, businesses have had to contend with a host of new and ongoing challenges over the past year. Specifically, 2021 saw the second year of the COVID-19 pandemic. And while some businesses were able to resume operations similar to their pre-pandemic norms, other businesses struggled to regain their footing. Further complicating matters, 2021 saw an acceleration of supply chain issues and labor shortages. All of these factors have profoundly affected many industries’ ability to operate at full capacity.

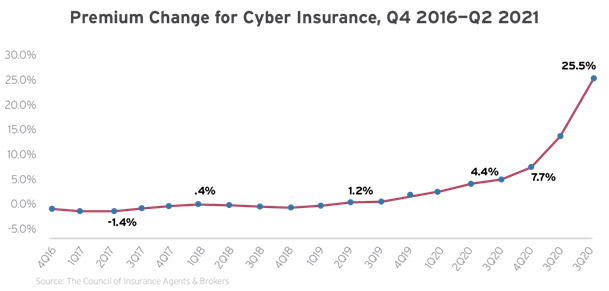

While the hard insurance market remains, there are some positive indicators for businesses. In the second half of 2021, we saw a gradual softening of the insurance market for certain lines. While insurance prices are still above their historical averages and insurance companies are applying rate increases, the scale of such increases has decelerated. Yet, there are several exceptions to this trend. In particular, cyber liability, fiduciary liability and commercial auto insurance are all still in the midst of hardening markets.

Going into 2022, we expect a challenging insurance environment to remain, but one that will look better than 2021 for many insurance buyers. However, there are a number of exceptions. Now more than ever, it’s essential for businesses to take a proactive approach to bolstering their risk management efforts and securing adequate insurance coverage. In other words, amid an insurance and risk environment with many unknowns, businesses should focus on addressing the factors they can influence.

Nevertheless, you are not in this alone. To help you navigate the insurance market, you need an insurance professional who understands your business, helps you plan for unique risks and advocates on your behalf. Secondly, you need insurance professionals who can tell your story to insurance carriers in a way that will best position your business come renewal time. Third, you need to work with an insurance professional who understands the dynamics of the current insurance market cycle and how to navigate a hard market successfully. Lastly, you need an insurance professional who fully understands your industry, the dynamic insurance landscape and how to provide targeted loss control solutions.

Remember, in these challenging times, Associates Insurance Agency is here to provide the insurance guidance and expertise your business needs.

The Insurance Market Cycle: Hard vs. Soft Markets

The commercial insurance market is cyclical in nature, fluctuating between hard and soft markets. These cycles affect the availability, terms and price of commercial insurance, so it’s helpful to know what to expect in both a hard and soft insurance market.

A soft market, which is sometimes called a buyer’s market, is characterized by stable or even lowering premiums, broader terms of coverage, increased capacity, higher available limits of liability, easier access to excess layers of liability, and competition among insurance carriers for new business. On the other hand, a hard market, which is sometimes called a seller’s market, is characterized by increased premium costs for insureds, stricter underwriting criteria, less capacity, restricted terms of coverage and less competition among insurance carriers for new business.

certain unprofitable lines of insurance.

In what was one of the longest soft markets in recent years, businesses across most lines of insurance enjoyed stable premiums and expanded terms of coverage for decades. While the commercial insurance market hardened for a short period of time after the terrorist attacks of Sept. 11, 2001, the last sustained hard market occurred in the 1980s. However, after years of gradual changes, the market is firming, leading to increased premiums and reduced capacity.

Many factors affect insurance pricing, but the following are common contributors to the hardening market:

- Catastrophic (CAT) losses—Floods, hurricanes, wildfires and similar disasters are increasingly common and devastating. Years of costly disasters like these have compounded losses for insurers, driving up the cost of coverage overall, especially when it comes to commercial property policies.

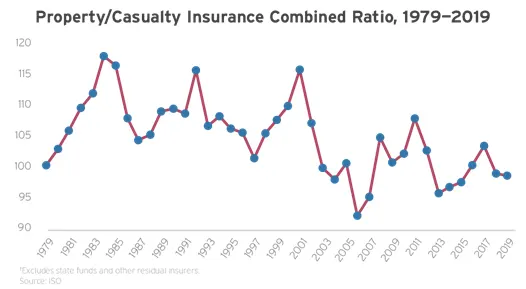

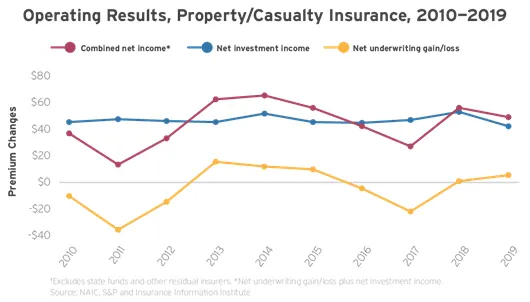

- Inconsistent underwriting profits—Underwriting profits refer to the difference between the premiums an insurer collects and the money it pays out in claims and expenses. When an insurance company collects more in premiums than it pays out in claims and expenses, it will earn an underwriting profit. Conversely, an insurance company that pays more in claims and expenses than it collects in premiums will sustain an underwriting loss. An insurance company’s combined ratio after dividends is a measure of underwriting profitability. This ratio reflects the percentage of each premium dollar an insurance company puts toward spending on claims and expenses. A combined ratio above 100 indicates an underwriting loss. Insurance companies generally do not generate profits from their underwriting operations. In the past 10 years, the commercial insurance industry has only had a combined ratio under 100 four times.

Mixed investment returns—Insurance companies also generate income through investments. Commercial insurance companies typically invest in various stocks, bonds, mortgages and real estate investments. Due to regulations, insurance companies invest significantly in bonds. These provide stability against underwriting results, which can vary from year to year. When interest rates are high and returns from other investments are solid, insurance companies can make up underwriting losses through their investment income. But when interest rates are low—like they currently are—insurers must pay close attention to their underwriting standards and other investment returns.

- The economy—The economy as a whole also affects an insurance company’s ability to write new policies. During periods of economic downturn and uncertainty, some businesses may purchase less coverage or forgo insurance altogether. A business’s revenue and payroll, which factor into how premiums are set, may decline. This creates an environment where there is less premium income for insurers.

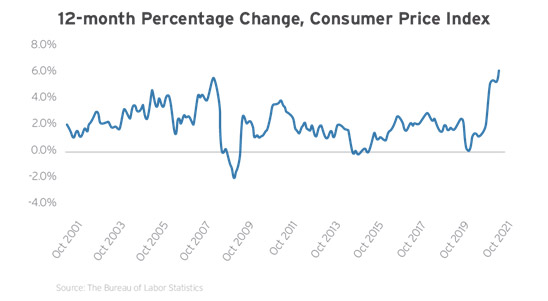

- The inflation factor—Prolonged periods of inflation can make it challenging for insurance carriers to maintain coverage pricing and subsequently keep pace with more volatile loss trends. Unanticipated increases in loss expenses can result in higher incurred loss ratios for insurance carriers, particularly as inflation affects key cost factors (e.g., medical care, litigation and construction expenses). In 2021, rising inflation was reflected within the commercial property and auto segments by way of higher costs for building materials, auto parts and skilled labor. These inflation concerns are expected to continue during 2022, potentially contributing to increased coverage costs.

- The cost of reinsurance—Generally speaking, reinsurance is coverage for insurance companies. Carriers often buy reinsurance for risks they can’t or don’t wish to retain fully, including those for severe weather events like hurricanes and wildfires. It’s a way for primary insurers to protect against unforeseen or extraordinary losses. As a result, reinsurance helps stabilize premiums for regular businesses by making it less of a risk for insurance carriers to write a policy. However, reinsurers have exposures to many of the same events and trends affecting insurance companies. For 2022, reinsurance is becoming more expensive to obtain, which is reflected in the overall cost of insurance for businesses.

Additional Factors That Influence Your Insurance Rates

In addition to the above, the following are additional factors that may influence your insurance rates:

The coverage you’re seeking—The forms of insurance you’re seeking, as well as the details of the coverage (e.g., limits of liability and value of insured property), will affect your insurance pricing.

The size of your business—As a general rule, the more employees your business has and the larger your revenue is, the higher you will pay for your insurance.

The industry in which you operate—Certain industries carry more risk than others. In general, businesses in these sectors are more likely to file insurance claims. As a result, businesses involved in risky industries tend to, on average, pay more in insurance premiums.

The location of your business—The location of your business will also influence your commercial insurance rates. If your business is located in an area prone to certain natural disasters, insurers may determine that your facility is more at risk for property damage. This increased risk will translate to higher insurance premiums.

Your claims history—Your business’s claims history, often referred to as your loss history, will also have an impact on insurance rates. If your business has an extensive claims history, then insurance carriers will tend to consider your company more likely to file future claims. This, in turn, means that your business will be viewed as risky to insure, subjecting you to higher commercial insurance premiums.

Your risk management practices—Now more than ever, conducting a careful assessment of your business’s unique exposures and establishing effective, well-documented risk management practices can make your establishment more attractive to insurance carriers. After all, having a robust risk management program in place reduces the likelihood of costly claims occurring, as well as minimizes the potential losses that your business could experience from an unexpected event.

Put simply, during a hard market, insurance buyers may face complex considerations regarding their insurance coverage. Thankfully, businesses are not without recourse in the face of a hard market. Business owners who proactively address risk losses and manage exposures will be better prepared for a hardening market than those who do not. Furthermore, those who educate themselves on the trends that influence their insurance will better understand what can be done to influence their insurance rates.

Trends to Watch in 2022

Insurance experts often examine how outside influences and trends affect the insurance marketplace, and businesses should follow suit to determine what factors impact their insurance coverage. For 2022, there are a number of sweeping market developments to consider.

Labor Shortages

The past year has seen labor shortages across industry lines. According to a recent study from the Society for Human Resource Management (SHRM), nearly 90% of organizations are having a hard time filling open positions. The industries experiencing the most substantial labor shortages include manufacturing, hospitality, health care and retail. Of the positions currently available, the majority (79%) of organizations are experiencing difficulty filling entry-level positions. Additionally, most (61%) organizations reported that hourly positions have been the hardest to fill.

A variety of factors have contributed to these widespread labor shortages. Primarily, the impact of the COVID-19 pandemic has caused many workers to reevaluate their employment priorities and made unemployed individuals apprehensive of returning to the workforce—with the proportion of people who have been out of work for six months or longer at its highest point in 60 years. The SHRM study found that nearly one-third (32%) of unemployed individuals have remained out of work due to concerns over COVID-19 exposure on the job, while 27% have done so because of salary issues. Further, over 20% of unemployed individuals with caretaking responsibilities have stayed out of a job because they lack access to reliable care. This issue is especially prevalent among female employees, as 3 million women left the workforce during the pandemic. As such, many individuals are seeking jobs with greater flexibility (e.g., nontraditional hours and remote capabilities), additional paid time off, higher pay and workplace arrangements that promote health and safety.

To help combat these labor shortages and attract skilled job candidates, organizations have had to make a number of workplace adjustments. The SHRM study found that 57% of organizations have started offering referral bonuses to fill open positions, while 43% have increased pay and 23% have provided sign-on bonuses for these positions. In addition to monetary offerings, 23% of organizations have begun offering extra workplace benefits, discounts or other incentives (e.g., flexible hours, caretaking support, more advanced technology and remote options) to attract employees. Looking forward, organizations will need to remain innovative in meeting their employees’ shifting expectations and attracting talent.

Supply Chain Issues

Since the onset of the pandemic, a range of supply chain disruptions have taken place. The majority of these issues stemmed from increased demand for various items and materials amid a slowdown in production and subsequent lack of availability during pandemic-related closures. Even as organizations have resumed their normal operations and increased production levels, consumer demand for certain items and materials has continued to outweigh inventory. This is likely attributed to a greater number of consumers making large purchases from accumulated savings throughout the pandemic. Creating further supply chain bottlenecks, an ongoing shortage of warehouse workers and truck drivers has slowed shipment and delivery times for high-demand goods.

These supply chain disruptions have impacted a number of industries. According to the U.S. Census Bureau, the sectors that have experienced the greatest supply chain difficulties include the manufacturing, construction and retail trade industries. Some of the most significant supply chain concerns have included shortages of building materials (e.g., steel and lumber) and vehicle parts (e.g., car chips). These particular inventory issues are directly associated with new home and vehicle sales spiking to their highest level in over a decade, as well as an increase in home improvement projects and accidents on the road that require vehicle repair services.

Several economic experts believe these supply chain issues will continue into at least the first half of 2022 before eventually subsiding. With this in mind, it’s important for organizations of all sectors to be prepared for potential supply chain bottlenecks in the months ahead and have contingency plans to help them stay operational amid any disruptions.

Inflation

The culmination of widespread labor shortages and supply chain disruptions have largely contributed to rising inflation issues in the commercial insurance space. In fact, the Bureau of Labor Statistics (BLS) reported that the consumer price index (CPI) for all urban consumers increased by 6.2% throughout the past year, thus inflating total loss expenses in the property and casualty markets.

Within the property insurance space, the cost to repair or rebuild structures following a loss has soared. This is because worker shortages within the construction industry have led to increased labor costs. At the same time, supply chain issues related to various essential building materials caused the price of these items to skyrocket. According to the National Association of Home Builders, the costs of lumber and steel have more than doubled amid the COVID-19 pandemic. According to the BLS, such inflation is further evidenced by a substantial increase over the past year for a number of structural elements—including floor coverings, window coverings, major appliances and overall construction materials. In the auto insurance market, vehicle repair expenses and subsequent accident costs have also surged. This trend is predominately caused by worker shortages in the auto industry generating elevated labor costs and supply chain disruptions for several critical vehicle parts (and vehicles overall), leading to higher prices for such items. These concerns are reflected in an increased CPI throughout the last year for auto parts, motor vehicle repairs and used cars and trucks, according to the BLS.

Going into 2022, economic experts predict that rising inflation will continue to be a pressing concern. While it’s currently making the most significant impact on the property and auto insurance markets, such prolonged inflation will likely begin to affect additional segments—such as the workers’ compensation and liability insurance spaces—over time. This means that insurance carriers will face challenges as it pertains to maintaining insurance pricing to keep up with more volatile loss trends. To prevent unanticipated loss costs and increased loss ratios due to rising inflation concerns, carriers may need to increase premium expenses and make other coverage adjustments. Nevertheless, it’s important to note the insurance industry as a whole is better positioned to incur losses to its reserves when compared to previous periods of prolonged inflation in U.S. history (i.e., the 1980s).

Social Inflation

As an insurance buyer, you may have heard the term “social inflation” used to explain one of the factors driving up the cost of insurance in today’s market. In general, this term refers to societal trends that influence the ever-rising costs of insurance claims and lawsuits. As the insurance market changes, it’s important for businesses to understand what’s currently driving social inflation.

Litigation Funding

One of the factors driving social inflation has to do with increased litigation or, more specifically, litigation funding. Litigation funding is when a third party provides financing for a lawsuit. In exchange, the third party receives a portion of the settlement. In the past, the steep cost of attorney fees would often scare plaintiffs away from taking a lawsuit to trial. But, through litigation funding, most or all of the costs associated with litigation are covered by a third party, which has increased the volume of cases being pursued.

Not only is litigation funding becoming more common, but it also increases the cost of litigation, sometimes to seven figures. This is because plaintiffs can take cases further and seek larger settlements.

Tort Reform

Tort reform refers to laws that are designed to reduce litigation. Specifically, tort reforms are used to prevent frivolous lawsuits and preserve laws that prevent abusive practices against businesses.

Many states have enacted tort reforms over the last several decades, leading to fewer claims and caps on punitive damages. However, in recent years, a number of states have modified tort reforms or challenged them as unconstitutional. Opponents believe tort reforms lower settlements to the point where attorneys are less likely to take on new cases and help victims get justice for their injuries or other damages.

Further complicating matters, tort reform is subject to uncertainty, as it’s largely tied to political leanings and the interests of individual states. Should tort reform continue to erode, there could be fewer restrictions on punitive and noneconomic damages, statutes of limitations and contingency fees—all of which can drive up the cost of claims and exacerbate social inflation.

Plaintiff-friendly Legal Decisions and Large Jury Rewards

The overall public sentiment toward large businesses and corporations is deteriorating, and anti-corporate culture is more prevalent than ever. A number of factors are contributing to this increasing distrust, including highly publicized issues related to the mishandling of personal data and social campaigns.

This has had a considerable impact on how businesses are perceived by a jury in court, and organizations are held to a high standard for issues related to the way they conduct their business. In fact, juries are increasingly likely to sympathize with plaintiffs, especially if a business’s reputation has been tarnished in some way in the past. As a result, plaintiff attorneys are likely to play to a jury’s emotions rather than the facts of the case.

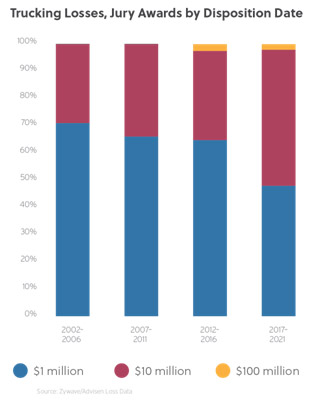

Compounding this issue, there’s an increasing public perception that businesses—particularly large ones—can afford the cost of any damages. This means juries are likely to have fewer reservations when it comes to awarding damages. In the current environment, nuclear verdicts (awards of $10 million or more) have become more common.

Extreme Weather Events

Extreme weather events—like hurricanes, tornadoes, hailstorms and wildfires—continue to make headlines as they become increasingly devastating and costly. Making matters worse, these events aren’t limited to one geographic area or weather event, impacting businesses and residents across the United States.

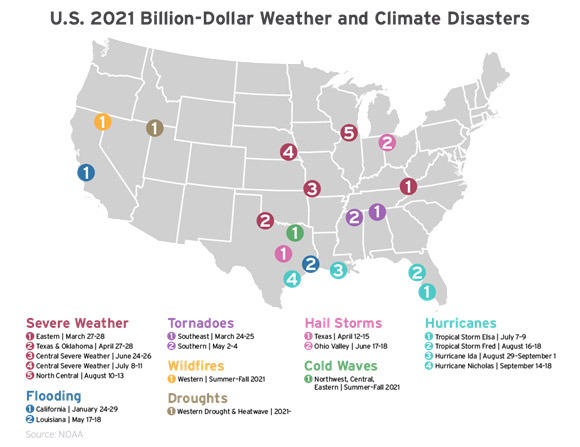

According to data from the National Oceanic and Atmospheric Administration (NOAA), wildfires again plagued the West Coast in 2021, recording a year-end total of more than 52,000 wildfires and burning over 6.6 million acres. Widespread drought and several heatwaves in the Western and Central United States caused over 200 fatalities and cost billions in damages. Hundreds of tornadoes wreaked havoc across various Southeastern and Northeastern states, while hailstorms, strong winds and heavy snow impacted the Midwest. On the East Coast, the 2021 hurricane season recorded the third-highest number of storms in history, causing over $70 billion in damages and affecting multiple states along the Atlantic Ocean.

One of the most devastating weather events from this past year was Hurricane Ida. According to the NOAA, this Category 4 hurricane generated 150 mph winds upon making landfall in Port Fourchon, Louisiana—one of only three hurricanes in history to generate such strong winds in that state. The hurricane destroyed 100% of the homes in Grand Isle, Louisiana, and severely damaged the energy infrastructure across the state—leaving millions without power. The remnants of the hurricane then led to immense flooding from Pennsylvania to New York. In total, the hurricane caused nearly 100 fatalities and incurred $64.5 billion in total damages.

Another notable weather event from 2021 was the Texas winter storm. During this storm, the NOAA reported that a historic cold wave swept across the state, with temperatures 40 degrees Fahrenheit below average. The prolonged, below-freezing weather damaged many structures due to burst pipes and caused widespread power outages—leaving 10 million people without power during its peak. The storm became the costliest U.S. winter weather event on record, incurring $20.8 billion in damages and causing 172 fatalities. As a whole, the storm contributed to over 456,000 property and casualty insurance claims.

Many experts believe severe storms, extreme temperatures, wildfires and flooding are the new norm. As these catastrophes become more frequent, the insurance industry will need to adopt innovative solutions to keep up with weather-related losses. Moving forward, expect to see more emphasis on weather readiness, especially from an insurer’s perspective.

Social Movements

Several social movements rose to prominence in recent years, with the implications of these movements expected to affect organizations for the foreseeable future. The Black Lives Matter movement was initially founded in 2013 but resurged in 2020 in the form of nationwide protests and civil unrest. This movement has pushed for increased accountability regarding racial injustice (both at the corporate and individual level) and encouraged organizations of all sizes and sectors to make strides in promoting racial equality and diversity within their workforce.

In addition to the Black Lives Matter movement, the #MeToo movement—an anti-sexual harassment campaign founded in 2006 but resurged in 2017 across social media—has repeatedly reigned as a relevant topic for many organizations in recent years. Since its resurgence, this movement has empowered employees to call out instances of inappropriate behavior, contributing a sharp increase in work-related sexual harassment claims, especially regarding employees alleging sexual harassment from senior leadership. The movement has highlighted the need for all organizations to implement sexual harassment prevention and response measures (e.g., a zero-tolerance policy, awareness training and well-documented reporting procedures).

These movements have contributed to the rising trend of increased corporate accountability regarding social issues, thus elevating the risk of employment-related claims alleging discrimination, harassment or other forms of unfair treatment. Moving forward, employers need to respond accordingly amid such social movements, routinely adjusting organizational practices to ensure a positive, inclusive and diverse work environment. Failing to do so could result in increased losses and subsequent claims, as well as severe reputational damages. Policyholders who take the necessary actions to avoid such claims by documenting workplace inclusivity, diversity and social awareness initiatives may reap the benefits of reduced premiums.

2022 Market Outlook Forecast Trends

Price forecasts are based on industry reports for individual lines of insurance. Forecasts are subject to change and are not a guarantee of premium rates. Insurance premiums are determined by a multitude of factors and differ per organization. These forecasts should be viewed as general information and not insurance or legal advice.

| LINE OF COVERAGE | PRICE FORECAST |

| Commercial property | Overall: +5 to +15% |

| General liability | Overall: +2.5 to +15% |

| Commercial auto | Overall: +10 to +25% |

| Workers’ compensation | Overall: -2 to +5% |

| Cyber liability | Overall: +15 to +50% |

| Directors and officers liability | Private/nonprofit entities: +5 to 35% Public companies: +5 to +25% |

| Employment practices liability | Overall: +10 to +25% |

Commercial Property Insurance

The commercial property insurance market has steadily hardened in recent years, resulting in quarterly rate increases since Q3 2017. Unfortunately, these rate increases—as well as additional policy restrictions—are expected to continue in 2022. Yet, this market may showcase some signs of moderation compared to 2021’s trends.

Such unfavorable market conditions are the result of another intense season of natural disasters (e.g., wildfires, hurricanes, windstorms, hail and floods) and the ongoing COVID-19 pandemic. An uptick in losses stemming from these trends has forced commercial property insurance carriers to elevate policyholders’ premium costs and implement more restrictive coverage terms.

We predict that many insureds will experience single or double-digit rate increases, lowered available capacity, higher sub-limits, and various policy restrictions or exclusions—especially regarding losses tied to weather events or the COVID-19 pandemic. Policyholders who conduct high-risk operations with poor loss control practices or are located in natural disaster-prone areas may encounter more severe rate changes, higher retentions and decreased coverage limits.

Developments and Trends to Watch

- Natural disasters—According to the National Interagency Fire Center, the 2021 wildfire season resulted in over 52,000 wildfires—burning more than 6.6 million acres and destroying thousands of structures across North America. In addition to wildfires, the NOAA reported that the 2021 Atlantic hurricane season produced 21 named storms, representing the third-most active hurricane season in history and totaling $70 billion in overall costs. As a whole, the NOAA recorded 18 natural disasters with losses exceeding $1 billion in the United States during 2021. What’s worse, many climate experts predict that both the frequency and severity of natural disasters will continue to worsen in the coming years. These catastrophes often leave behind devastating property damage for affected establishments, leading to significant rebuilding concerns.

- Supply chain and inflation issues—The COVID-19 pandemic has contributed to a range of supply chain disruptions within the past few years. Specifically, the availability of numerous building materials—namely, lumber and steel—dwindled throughout 2021 as demand for these items soared. As such, the price of these materials skyrocketed, thus inflating overall property construction costs. In fact, the Insurance Journal reported that property construction expenses increased by 8.1% between 2020 and 2021. Compounding concerns, ongoing worker shortages in the construction industry have led to elevated labor costs and project delays. Consequently, organizations may face unexpected costs, greater claims severity and possible underinsurance issues if a property-related loss requires them to rebuild. Although industry experts predict that surging construction costs will eventually subside during 2022, overall inflation issues are expected to continue—potentially keeping property rebuilding expenses and subsequent claims costs high for years to come.

Tips for Insurance Buyers

- Work with your insurance professionals to begin the renewal process early. Many commercial property insurers are seeing an increased submission volume. Timely, complete and quality submissions are vital to ensure your application will be reviewed by underwriters.

- Determine whether you will need to adjust your business’ retentions or limits to manage costs.

- Gather as much data as possible regarding your existing risk management techniques. Be sure to work with your insurance professionals to present loss control measures you have in place.

- Conduct a thorough inspection of both your commercial property and the surrounding area for specific risk management concerns. Implement additional mitigation measures as needed.

- Analyze your organization’s natural disaster exposures. If your commercial property is located in an area prone to a specific catastrophe, implement mitigation and response measures (e.g., install storm shutters on windows to protect against hurricane damage or utilize fire-resistant roofing materials to protect against wildfire damage) to protect your property as much as possible.

- Develop a documented business continuity plan (BCP) that will help your organization remain operational and minimize damages in the event of an interruption. Test this BCP regularly with various possible scenarios. Make updates when necessary.

- Address insurance carrier recommendations. Insurers will be looking at your loss control initiatives closely. Taking the appropriate steps to reduce your risks whenever possible can make your business more attractive to underwriters.

Commercial Auto Insurance

Over the past decade, the commercial auto space has been challenging and largely unprofitable for insurance carriers. According to a recent report from AM Best, commercial auto underwriters saw more than $22 billion in underwriting losses between 2011 and 2020. This is despite underwriters increasing commercial auto premium pricing for 41 consecutive quarters, dating back to Q3 of 2011.

Various factors have led to this poor underwriting performance, including litigation trends, a profound commercial driver shortage, a wide range of driver safety failures, medical treatment inflation, distracted driving, surging accident expenses and a deteriorating public road infrastructure. In this environment, many commercial auto insurance carriers have elevated premium costs—with some policyholders experiencing double-digit rate increases. Even amid premium surges, as an industry, insurance carriers have not returned an underwriting profit for commercial auto lines in over a decade. Looking ahead, industry experts predict that this hard market will continue to be a concern in 2022 and beyond. As such, we predict that the majority of businesses with commercial auto exposures—regardless of their industry or vehicle class—will have a more difficult renewal process by way of greater premium rates, lowered capacity and more stringent policy requirements or restrictions. Further, insureds with larger fleets or a poor loss history may experience more significant rate increases.

Developments and Trends to Watch

- Nuclear verdicts—Settlement verdicts for bodily injury claims have been rising steadily. Specifically, nuclear verdicts—which refer to jury awards in which the penalties exceed $10 million—have become increasingly prevalent. According to recent Advisen loss data, the percentage of trucking awards exceeding $10 million jumped 15% over the past four years. These large losses accounted for 35% of all trucking losses over $1 million from 2017 to 2021. This is a notable increase from the previous eight years when trucking awards over $10 million accounted for just 20% of losses over $1 million. Due to the rise in nuclear verdicts, attorneys are more inclined to go to trial. This extends litigation and significantly raises the cost to defend a claim. What’s worse, the surge in nuclear verdicts over the years has contributed to many commercial auto insurance carriers either decreasing their risk appetites and restricting coverage offerings or exiting the market altogether. As a result, insureds impacted by nuclear verdicts are less likely to have sufficient coverage for these events—potentially leading to financial devastation when they occur.

- Driver shortages—According to the American Trucking Associations (ATA), there is currently a driver shortage of more than 80,000 positions—largely fueled by the aging workforce, a declining interest in the profession and certain industry barriers. Making matters worse, the ATA estimates 160,000 commercial driver positions could be unfilled by 2030. In fact, the trucking industry will have to recruit nearly 1 million drivers within the coming decade to adequately replace retiring drivers and fuel sector growth. The driver shortage is so profound that the White House’s recently passed federal infrastructure bill includes funding for an apprenticeship pilot program intended to encourage commercial driver’s license holders under the age of 21 to operate in interstate commerce. Amid this shortage, many organizations have had to lower their driver applicant standards to fill open positions. These drivers often have fewer years of experience and shorter driving records. Such factors can make these new employees more likely to be involved in an accident on the road. Driver shortages have also forced some organizations to compete for experienced drivers.

- Distracted driving issues—Distracted driving reduces awareness, decision-making capabilities and overall performance on the road—increasing the likelihood of driver error, near-crashes or crashes. Data from the National Highway Traffic Safety Administration (NHTSA) indicates that, every year, up to 391,000 people are injured, and 3,450 people are killed in crashes involving distracted drivers. As a whole, distracted driving incidents account for nearly 10% of all fatal crashes on the road. In addition to loss of life, these crashes cost an estimated $46 billion each year. As these incidents have become more prevalent, commercial auto insurance costs have climbed in tandem.

- Marijuana legalization exposures—In recent years, a growing number of states have legalized recreational marijuana and other cannabinoids. More than one-third of the country currently permits the use of recreational marijuana for adults ages 21 and older. As more adults are able to use marijuana, however, there have been concerns over how such legalization could impact road safety. After all, research from the Insurance Institute for Highway Safety showed that crash rates surged in several states—including California, Colorado and Oregon—following the legalization of recreational marijuana. Furthermore, NHTSA data found that cannabinoid use among fatally injured drivers has more than doubled over the last decade. While all states have some form of legislation in place regarding marijuana-impaired driving, many enforcement limitations still exist due to minimal drug-detecting technology and the lack of a widely recognized impairment limit. Going forward, more states are expected to address recreational marijuana usage within their drug-impaired driving programs—making it crucial for organizations to ensure compliance among their drivers.

- Crash severity concerns—One of the main culprits of surging accident costs (and subsequent commercial auto claims) over the years is worsening crash severity. Even though fewer drivers were on the road in 2020 due to the COVID-19 pandemic, the NHTSA reported that an estimated 38,680 individuals were killed in motor vehicle crashes throughout the year—representing a 7.2% increase from the previous year and the highest annual death toll since 2007. Such crashes have been linked to a rise in unsafe behaviors behind the wheel (e.g., speeding and neglecting to wear a seat belt). As more drivers returned to the road in 2021, the country’s fatal crash rate continued to climb—rising by an additional 3% in the first six months alone. Although the federal government wants to combat road fatalities by investing further in driver safety initiatives, these incidents remain a pressing concern. Besides fatal crashes, road incidents resulting in severe injuries have also contributed to rising accident costs. This is because such injuries often require multiple doctor visits, complex procedures (e.g., surgery) and advanced treatment plans, which can extend recovery time and influence overall medical costs.

- Repair cost obstacles—Another key culprit of increasing accident costs is elevated vehicle repair expenses. While a variety of modern vehicle features—including blind-spot cameras, backup alarms, GPS devices and telematics software—have largely benefited businesses and their drivers on the road, repairing this advanced technology comes with a hefty price tag. In fact, according to a recent report from AAA, vehicles equipped with driver assistance systems often cost twice as much to repair as those that aren’t. In addition, widespread supply chain issues caused by the ongoing COVID-19 pandemic have also contributed to surging vehicle repair expenses. With demand exceeding availability for various auto parts and other necessary materials, repair costs among damaged vehicles have skyrocketed. Further, replacing vehicles has also become a challenge due to the overall vehicle shortage. Data from AlixPartners shows that 7.7 million fewer vehicles were produced in 2021 due to supply chain complications. Industry experts predict that these shortages could stretch into 2022, therefore continuing to impact vehicle repair expenses.

Tips for Insurance Buyers

- Examine your loss control practices relative to your fleet and drivers. Enhance your driver safety programs by implementing or modifying safe driving and distracted driving policies.

- Design your driver training programs to fit your needs and the exposures facing your business. Regularly retrain drivers on safe driving techniques.

- Establish adequate driving schedules to reduce driver fatigue. Educate employees on driver fatigue and encourage them to take a break if they start experiencing symptoms behind the wheel.

- Assess the risks associated with offering delivery services and implement measures to minimize potential damages (e.g., driver training programs and safe delivery protocols).

- Ensure you hire qualified drivers by using motor vehicle records (MVRs) to vet drivers’ experience and moving violations. Disqualify drivers with an unacceptable driving record. Review MVRs regularly to ensure that drivers maintain good driving records. Define the number and types of violations a driver can have before they lose their driving privileges.

- Consider technology solutions, such as telematics, where appropriate to strengthen and supplement other loss control measures.

- Implement a driver- or employee-retention program to maintain experienced drivers.

- Prioritize organizational accident prevention initiatives and establish effective post-accident investigation protocols to prevent future collisions on the road.

- Examine your Federal Motor Carrier Safety Administration BASIC scores to identify gaps in your fleet management programs, if applicable.

- Determine whether you should make structural changes to your commercial auto policies by speaking with your insurance broker.

Cyber Liability Insurance

The cyber insurance market is at a critical juncture for both insurance carriers and policyholders. While the last few years have seen increased competition among cyber insurance carriers, higher capacity and expanded coverage terms, both 2020 and 2021 saw a rapidly hardening cyber insurance market. Across industry lines, cyberattacks—namely, ransomware attacks and business email compromise scams—have surged in both cost and frequency. This increase in attacks has, in turn, resulted in a rise in cyber liability claims and subsequent underwriting losses. At a time when businesses are looking to purchase cyber insurance for the first time or to expand upon their existing coverage, many carriers are taking a more cautious approach to this line of insurance. In particular, carriers are managing the deployment of capacity more stringently than in past years. For example, in instances where insurance carriers previously offered policies with limits of up to $10 million, the market is now seeing smaller layers closer to $5 million. What’s more, reinsurers have also begun restricting the capacity they offer to insurance carriers, while pressuring carriers to take a more proactive approach to underwriting cyber liability insurance.

In light of these market conditions, we predict that most policyholders will experience higher cyber liability insurance rates in 2022, with many insureds seeing double-digit rate increases. Apart from increased premium costs, insureds may also encounter coverage restrictions, further scrutiny from underwriters regarding cybersecurity practices, and exclusions or sub-limits for losses stemming from specific types of cyber incidents (e.g., ransomware attacks). Policyholders who operate in industries with more pronounced cyber exposures (e.g., education, technology, health care, finance, retail and hospitality) may experience greater rate increases. If policyholders fail to demonstrate proper cybersecurity protocols or have experienced cyber incidents in the past, coverage will be increasingly difficult to obtain.

Developments and Trends to Watch

- Tightened underwriting standards—With cyberattacks on the rise, cyber insurance carriers have adjusted their underwriting practices to help mitigate the risk of costly claims. These practices include the following:

- Asking for more documentation—Rather than providing a simple coverage application or asking questions about existing cybersecurity measures, carriers are now requiring more substantial documentation from their insureds. This may include detailed documentation related to workplace cyber policies, incident response planning, employee training, data storage and recovery processes, email safeguards, user authentication protocols, and security software capabilities. Furthermore, carriers may require insureds to fill out additional applications or provide extra documentation related to the specific prevention measures they have in place for growing cyber threats. Some carriers have even begun incorporating advanced scanning technology into their underwriting processes to better assess policyholders’ current cybersecurity practices and identify ongoing vulnerabilities.

- Minimizing coverage capabilities—In addition to asking for further documentation, some cyber insurance carriers have also decreased their risk appetite and reduced their coverage offerings—especially as it pertains to protection for losses stemming from certain cyberattack methods. For instance, insureds are more likely to encounter policy exclusions or sub-limits regarding coverage for ransomware attacks, seeing as such attacks are rapidly increasing.

- Reducing policy ambiguity—To prevent insureds from leveraging their cyber coverage for unintended purposes, some carriers have changed their policy wording to be less ambiguous. This adjusted wording can help carriers more clearly outline the types of cyber events they cover, as well as when and how coverage will be triggered amid these events. Through specific policy language, carriers can also provide more exact definitions for important policy terminology.

- Elevated ransomware concerns—Ransomware attacks—which entail cybercriminals compromising a device or server and demanding a large payment be made before restoring the technology (as well as any data stored on it)—have been steadily increasing in recent years. Cybersecurity experts confirmed that these incidents have surged by over 500% since 2018. Such a rise is likely tied to cybercriminals becoming increasingly sophisticated and developing more avenues for launching these attacks (e.g., ransomware-as-a-service and remote desk protocol). What’s worse, ransomware attacks often carry more significant costs than other types of cyber incidents due to their associated payment demands and data recovery efforts. According to NetDiligence’s annual cyber claims study, ransomware attacks were the largest driver of cyber insurance claims over the last five years—with the average ransom demand rising to $247,000 and the median incident cost reaching $352,000.

- Increased double extortion issues—Compounding current ransomware attack concerns, double extortion attacks are now a potential cybersecurity concern for organizations across industry lines. This technique follows a similar protocol to that of a typical ransomware attack but comes with an extra threat. The victim must pay a ransom to regain access to their technology and data and keep that data from being uploaded publicly online. Double extortion ransomware attacks can be significantly more damaging for affected organizations than typical ransomware incidents. This is because even if organizations have protocols in place (e.g., storing data in multiple secure locations) that allow them to recover their compromised information without paying a ransom, they may still be pressured to do so in order to keep their data from going public. Additionally, cybercriminals who conduct double extortion ransomware attacks are known to demand higher ransom payments, sell or trade stolen data to other attackers for future extortion attempts and still move forward with sharing data publicly even after the ransom is paid (whether on purpose or by accident)—making these attacks all the more harmful.

- Greater government involvement—In response to the rise in ransomware attacks throughout the country, the White House released a letter this past June, stating that President Joe Biden’s administration is taking this cyber threat seriously. Within the letter, the Biden administration also encouraged corporate executives and business leaders to play their part in minimizing ransomware attacks by assessing their exposures and adopting proper prevention measures. Such measures include utilizing the federal government’s cybersecurity best practices, conducting frequent data backups, maintaining updated security software, ensuring an effective incident response plan, reviewing current cyber protocols and keeping critical workplace networks segmented.

- Heightened business email compromise risks—Put simply, a business email compromise (BEC) scam entails a cybercriminal impersonating a seemingly legitimate source—such as a senior-level employee, supplier, vendor, business partner or other organization—via email. The cybercriminal uses these emails to gain the trust of their target, thus tricking the victim into believing they are communicating with a genuine sender. From there, the cybercriminal convinces their target to wire money, share sensitive information (e.g., customer and employee data, proprietary knowledge or trade secrets) or engage in other compromising activities. According to the latest loss data from Advisen, BEC scams are among the most expensive types of social engineering losses, and they are on the rise—increasing 58% from 2015 to 2019. The median cost of a BEC loss is $764,000—significantly more expensive than other social engineering losses, which average around $580,000.

- Additional fallout from notable attacks—Finally, there has been lasting fallout within the cyber insurance market due to several large-scale supply chain cyberattacks that took place throughout 2021. Together, the widespread fallout from these incidents has motivated organizations of all sizes and sectors to review their supply chain cybersecurity risks and take steps to minimize their exposures. Additionally, these attacks have made cyber insurance carriers more reluctant to allow insureds to supplement their policies with dependent business interruption coverage, which can be particularly useful amid supply chain cyber events. Here’s an outline of the large-scale attacks:

- Microsoft Exchange—In January, state-sponsored hackers took advantage of four zero-day exploits (a type of software vulnerability) within Microsoft Exchange’s servers to launch a widespread malware attack. The malware is estimated to have impacted over 250,000 servers and more than 30 organizations serviced by Microsoft before it was mitigated in early March.

- Colonial Pipeline—In May, Colonial Pipeline was forced to temporarily shut down a 5,500-mile-long pipeline responsible for transporting 45% of the East Coast’s fuel supplies after falling victim to a double extortion ransomware attack. With the help of the FBI, Colonial Pipeline ended up paying the $5 million ransom payment within hours. However, the pipeline wasn’t restarted for nearly a week.

- Kaseya—In July, foreign hackers infiltrated the software of an IT firm known as Kaseya and utilized it to launch a major ransomware attack, impacting many of the firm’s customers via their managed service providers (MSPs). As many as 1,500 organizations were compromised through their MSPs due to this incident, which involved a record-breaking $70 million ransom demand.

Tips for Insurance Buyers

- Work withyour insurance professionals to understand the different types of cyber coverage available and secure a policy that suits your unique needs. Carefully determine whether your organization should purchase standalone cyber liability coverage.

- Take advantage of loss control services offered by insurance carriers to help strengthen your cybersecurity measures.

- Provide remote employees with adequate resources, support and software to avoid cybersecurity concerns amid work-from-home or hybrid arrangements.

- Focus on employee training to prevent cybercrime from affecting your operations. Employees should be aware of the latest cyber threats and ways to prevent them from occurring.

- Keep organizational technology secure by utilizing a virtual private network, installing antivirus software, implementing a firewall, restricting employees’ administrative controls and encrypting all sensitive data.

- Store backups of critical data in a secure, offline location to minimize losses in the event of a ransomware attack.

- Update workplace software regularly to ensure its effectiveness. Keep employees on a strict software update schedule and consider using a patch management system to assist with updates.

- Establish an effective, documented cyber incident response plan to remain operational and minimize damages in the event of a data breach or cyberattack. Test this plan regularly by running through various scenarios with staff. Make updates to the plan as needed.

- Develop workplace policies that prioritize cybersecurity—including an internet usage policy, a remote work policy, a bring your own device policy and a data breach response policy.

- Be sure to consider potential supply chain exposures when establishing your organization’s cybersecurity policies and protocols.

Directors and Officers (D&O) Liability Insurance

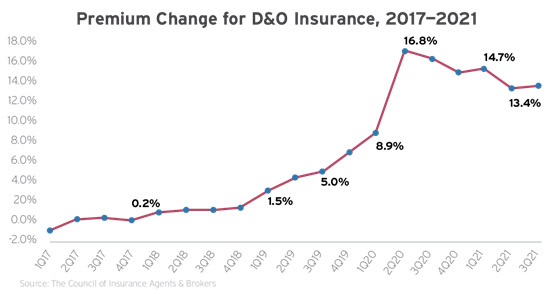

Although D&O insurance carriers offered mostly favorable pricing for businesses throughout much of the past 10 years, there has recently been a shift in the market by way of elevated rates and reduced capacity. Amid a new decade, the D&O market has only continued to harden, with double-digit rate increases becoming the norm for most insureds. Looking forward, insurance experts anticipate that the D&O market will continue to be challenging for many insureds.

In these market conditions, we predict that many businesses will experience rate increases, fewer markets, lower available limits, more robust underwriting and higher retentions during 2022. These rate increases are on top of the increases that many businesses experienced in previous years for their D&O coverage (both primary and excess layers). Insureds may also encounter various coverage reductions—including costly extended reporting period terms, the elimination of shareholder derivative demand investigative costs coverage and additional policy restrictions related to Side A insurance. While this is unwelcomed news, there is a silver lining. The pace of these increases appears to be decelerating for 2022 renewals relative to 2021.

Many factors that contributed to the initial D&O market shift have remained top concerns, including greater corporate accountability, evolving cybersecurity threats and increased litigation. However, a range of additional trends have also emerged within the market—namely, pandemic exposures, special

purpose acquisition company (SPAC) issues, climate change concerns and board diversity considerations.

Developments and Trends to Watch

- COVID-19 concerns—At its initial onset, the COVID-19 pandemic forced many organizations to make serious operational changes—such as conducting office closures, having employees work remotely and altering various workplace procedures to comply with health and safety standards. Such changes (or lack thereof) carried a wide range of D&O exposures, paving the way for stakeholders and shareholders to allege that organizations’ senior leadership teams failed to respond appropriately amid the pandemic. Although the nation’s economy largely reopened in 2021, recurring hot spots of COVID-19 infections and the emergence of new variants have caused many organizations to keep making workplace adjustments to protect their employees and stay operational. These adjustments include adopting back-to-work plans and implementing COVID-19 vaccine mandates. As such, senior leadership teams have continued to face scrutiny based on their pandemic responses, leading to allegations of mismanagement, increased litigation and related D&O claims. According to industry experts, pandemic-related D&O claims are expected to press on into 2022, while current claims may take years to resolve.

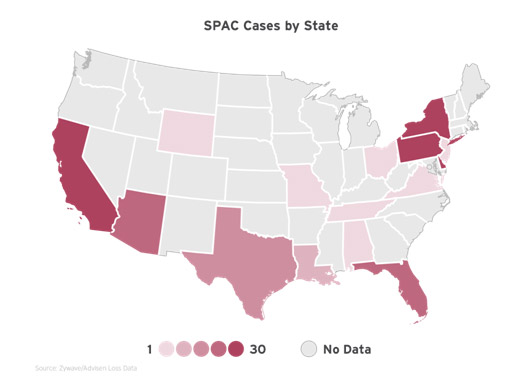

- Special purpose acquisition company (SPAC) risks—A SPAC is a corporation developed with the primary intention of raising investment capital through an initial public offering (IPO). The secured funds are then utilized to acquire an unspecified business (also called a target company), which is later identified following the IPO. As SPACS have surged in popularity, the U.S. Securities Exchange Commission (SEC) has held senior leaders who conduct these transactions increasingly accountable for potential wrongdoings, such as failing to perform their due diligence on a target company’s finances or providing shareholders with misleading information. Senior leaders are also at risk of being involved in various civil litigation scenarios stemming from SPAC transactions, including shareholder objections, negotiation breakdowns, bankruptcy problems and merger and acquisition issues. These scenarios could pave the way for disgruntled shareholders to file costly lawsuits against the senior leaders responsible for conducting SPAC transactions—thus resulting in D&O claims. According to industry experts, such lawsuits and subsequent D&O claims have surged in the past year, causing the price of D&O coverage for SPAC IPOs to increase nearly fivefold. Common D&O liability concerns stemming from SPAC transactions include shareholders alleging that senior leaders:

- Breached their duty of care by failing to negotiate with the target company in good faith, holding them responsible for subsequent negotiation shortcomings

- Misrepresented certain aspects of the target company or committed securities fraud, holding them responsible for an undesirable acquisition

- Neglected their fiduciary duty by failing to perform their due diligence in reviewing the target company for possible red flags, holding them responsible for the post-SPAC company’s underperformance or bankruptcy issues

- Cybersecurity struggles—As workplace technology continues to advance, so do the tactics of cybercriminals. Compounding concerns, the growing number of employees working remotely amid the COVID-19 pandemic has resulted in additional cyber exposures for organizations. When cyberattacks occur—whether it’s a data breach, ransomware incident or phishing scam—their costly consequences can often lead to D&O claims. After all, the decisions made by directors and officers are often intensely scrutinized following a cyberattack. Potential D&O losses can arise from allegations such as directors and officers failing to take reasonable steps to protect stakeholders’ personal or financial information, failing to implement controls to detect and prevent a cyberattack, and failing to report the incident or notify the appropriate parties in a timely manner. In light of these advancing cyber concerns, it’s important for directors and officers to be actively involved in developing and promoting effective workplace cybersecurity measures. By involving senior leadership in such initiatives, organizations can foster a culture of cybersecurity awareness and bolster their preparedness against cyber threats.

- Environmental, social and governance (ESG) topics—ESG activism has become increasingly prevalent in today’s business climate, making a noticeable impact on the D&O market. Rising ESG trends include the following:

- Climate change and pollution actions—Extreme weather events—including unprecedented wildfires, winter storms in Texas and an increased number of Category 4 and 5 hurricanes—have resulted in a rise of activist and societal pressure on governments and businesses to address climate change. There is also a rise in climate change litigation, with the cumulative number of climate change-related cases more than doubling since 2015. Much of the litigation alleges that companies and their boards of directors have failed to adequately disclose the material risks of climate change. Stakeholders are demanding transparency, and it is up to companies’ boards of directors to ensure appropriate reporting and due diligence regarding climate change.

- Greenwashing—Greenwashing refers to a deceptive marketing practice in which companies produce misleading information to trick consumers into believing an organization’s products, services or mission have more of a positive impact on the environment than is accurate. This practice undermines companies that actually implement sustainability efforts and can make it harder for environmentally conscious consumers to make eco-friendly decisions. As stakeholders and investors take more legal action in this area, unrealistic ESG targets could become the potential subject of litigation.

- Executive pay—Conversations about management compensation and pay transparency are gaining prominence as more companies link executive incentives to ESG-related metrics. According to a study from Harvard Law School, 45% of Financial Times Stock Exchange 100 companies have an ESG target in the annual bonus, long-term incentive plan or both. However, linking ESG and pay may not be practical since there isn’t yet a consistent or rigorous view on what “good” ESG performance looks like, and there is no clear guidance for companies on a “good” ESG performance measure.

- Board diversity considerations—Diversity among board members has become an increasingly important corporate necessity. Over the past few years, various regulators have developed standards regarding diversity expectations for organizations. At the federal level, the SEC released new disclosure requirements in 2018, calling on organizations to be more transparent about the diversity of their senior leadership teams. These requirements ask public organizations to share certain self-identified characteristics of their senior leaders (e.g., gender, race and sexual orientation). In 2021, the SEC approved a proposal from the National Association of Securities Dealers Automated Quotations (NASDAQ)—a major stock exchange—that requires NASDAQ-listed organizations to either include or publicly share why they have chosen not to include a set number of diverse members on their senior leadership teams and disclose annual reports regarding their leadership teams’ self-identified characteristics. Multiple states—including California, Washington and Maryland—have also recently implemented diversity-related requirements for organizations. Moving forward, it’s certainly possible for additional states to follow suit. With this in mind, organizations that misrepresent the diversity of their senior leadership teams or fail to ensure board diversity altogether could face shareholder litigation and subsequent D&O claims. As a result, underwriters in the D&O market are expected to ask more questions and seek additional documentation regarding policyholders’ diversity and inclusion practices.

Tips for Insurance Buyers

- Examine your D&O program structure and limits alongside your insurance professionals to ensure they are appropriate and take market conditions and trends into account.

- Consult insurance brokers, loss control experts and underwriters to better understand your D&O exposures and cost drivers in the market.

- Work closely with senior leadership to identify any ongoing risks that may arise from the COVID-19 pandemic and determine a course of action that prioritizes the needs of your stakeholders.

- Evaluate workplace adjustments (e.g., back-to-work plans and vaccine mandates) related to COVID-19 prior to implementation to ensure regulatory compliance and minimize legal or financial fallout.

- Make sure your senior leadership team carefully assesses potential exposures and maintains compliant, honest practices amid SPAC transactions. Pay close attention to SEC requirements for such transactions.

- Ensure your senior leaders follow safe financial practices (e.g., timely payments, educated investments, accurate documentation and reasonable reimbursement procedures). Be transparent with stakeholders about your organization’s economic state to avoid misrepresentation concerns.

- Make sure your senior leadership team is actively involved in monitoring your organization’s unique cyber risks. This can involve implementing proper cybersecurity practices to prevent potential attacks (especially in the realm of remote work arrangements), ensuring compliance with all applicable data security standards and establishing an effective cyber incident response plan to minimize any damages in the event of an attack.

- Prioritize establishing eco-friendly initiatives among your senior leadership team. However, ensure that these initiatives remain realistic to avoid greenwashing concerns. Furthermore, be sure your senior leadership team conducts their due diligence and provides proper reporting as it relates to climate change concerns.

- Implement measures to foster an inclusive workplace and ensure diverse representation within your senior leadership team.

Employment Practices Liability (EPL) Insurance

Like many other lines of insurance, the EPL insurance market has also hardened. This is due in part to a higher frequency and severity of claims in recent years, as well as increased legislative activity at both the state and federal levels. What’s more, the ongoing impact of the COVID-19 pandemic is a particularly pressing concern in the EPL market. Specifically, pandemic-related remote work operations, return-to-work plans, and furlough or layoff decisions have fueled a variety of EPL claims across industry lines (e.g., discrimination, invasion of privacy and retaliation). What’s more, uncertainty regarding COVID-19 and vaccine mandates has challenged the EPL further.

Apart from pandemic-related issues, the EPL market has also seen a recent rise in potential exposures due to a wide range of emerging trends—including an aging workforce, increased LGBTQ protections, social movements, employee privacy laws and widespread marijuana legalization. Moreover, judges and juries seem increasingly sympathetic to plaintiffs in employment-related actions.

Over the past few years, there has been an acceleration of large judgments (more than $5 million) issued against employers for EPL claims. In response, many carriers are decreasing their appetite to write new EPL business, and fewer carriers are competing for business. Further, insureds can expect increased underwriting scrutiny for EPL coverage, including questions around diversity and inclusion, HR practices, and COVID-19 initiatives (e.g., return-to-office plans and vaccine mandates).

For 2022, we anticipate the EPL rate environment to improve slightly over 2021. Yet, we predict that most policyholders will still experience rate increases in 2022. Larger organizations and insureds operating within riskier states (e.g., California, Illinois, Florida, New York and Texas) or industries (e.g., health care, retail, hospitality and leisure) may encounter larger rate increases.

Developments and Trends to Watch

- Pandemic-related claims—The ongoing COVID-19 pandemic has forced many organizations to make workplace changes—such as having employees work remotely, adjusting office setups and conducting staff layoffs or furloughs. And with these changes, EPL claims followed. According to the latest data from Fisher Phillips, there have been nearly 4,000 pandemic-related lawsuits filed against employers. Some of the top pandemic-related EPL claims since the initial onset of COVID-19 include:

- Allegations regarding employee leave concerns and remote work options (27.7% of claims)

- Allegations of discrimination related to workplace adjustments or layoffs (26% of claims)

- Allegations of retaliation (23.3% of claims)

- Allegations regarding wage and hour concerns (7.2% of claims)

- Allegations of unsafe work conditions (3% of claims)

- Allegations related to vaccine mandates (2.8% of claims)

- Vaccine mandates—With COVID-19 vaccines readily available across the country, workplace vaccination requirements have been a hot topic on both the state and federal levels. While the U.S. Equal Employment Opportunity Commission (EEOC) issued guidance explaining that employers are permitted to mandate COVID-19 vaccinations among their workforces, they must do so in compliance with Title VII and the Americans with Disabilities Act. In other words, employees can object to vaccine mandates if these requirements conflict with their religious beliefs or pose medical concerns related to their disabilities. As such, employers who issue vaccine mandates within their workplaces could face legal complications from employees who allege religious or disability discrimination, thus resulting in EPL claims. Furthermore, the culmination of executive orders from the White House, ongoing challenges to the federal government’s emergency temporary standard and conflicting state requirements regarding vaccine mandates have created additional confusion and compliance difficulties for employers. Looking ahead, these difficulties could potentially lead to increased vaccine-related EPL claims.

- Marijuana legalization considerations—For the past decade, many states have been moving toward the legalization of marijuana. Currently, medical marijuana is legal in 36 states, and recreational marijuana is legal in 19 states. As a result, some states have enacted legislation restricting an employer’s ability to conduct drug tests for marijuana. Additionally, several state court cases have ruled in favor of the employee in recent employment lawsuits related to marijuana usage. According to the latest Advisen loss data, 40% of marijuana-related EPL claims have stemmed from wrongful termination allegations—such as an employee getting fired for a positive drug test, even though they were using marijuana away from work for legal medical reasons. With this in mind, employers with outdated policies and procedures regarding marijuana testing and usage could face an increased risk of EPL claims.

- Social movements—Various social movements could play a part in employment litigation and subsequent EPL claims in 2022. The #MeToo movement, which is an anti-sexual harassment campaign that has garnered increased social media attention over the years, has since empowered employees to call out instances of inappropriate workplace conduct—largely contributing to a 50% rise in sexual harassment lawsuits against businesses in the last five years, according to the EEOC. In addition, the Black Lives Matter movement, which is a racial justice campaign that originated in 2013 and recently resurfaced, may motivate employees to speak out against racial inequities on the job—potentially becoming a factor in race-related workplace discrimination and harassment lawsuits in the years to come.

- LGBTQ protections—The U.S. Supreme Court recently made it clear that Title VII protects gay and transgender employees from workplace discrimination and harassment based on sexual orientation, gender identity and gender expression. While this is a somewhat new development, the Supreme Court’s decision could result in further discrimination-based EPL claims in 2022 and beyond, as LGBTQ employees may feel more encouraged to hold businesses accountable for unfair treatment.

- Retaliation claims—Retaliation is defined as an employer taking inappropriate actions against an employee for exercising their workplace rights. For example, an employer demoting a worker for filing a harassment complaint would qualify as retaliation. According to the EEOC, retaliation has repeatedly reigned as the top cause of employment litigation and subsequent EPL claims in the past few years. In fact, the most recent data confirmed that more than half of all employment charges filed with the EEOC involve retaliation. That being said, employers who fail to react appropriately when workers utilize their employment rights could encounter increased retaliation-related EPL claims going forward.

Tips for Insurance Buyers

- Review your employee handbook and related policies. Ensure you have all appropriate policies in place, including language on discrimination, harassment and retaliation.

- Implement effective sexual harassment prevention measures (e.g., a zero-tolerance policy and a sexual harassment awareness program), reporting methods and response protocols.

- Promote diversity, acceptance and inclusion in the workplace through staff education and training. Take any accusations or reports of discrimination seriously.

- Document all evaluations, employee complaints and situations that result in employee termination.

- Consult legal counsel for state-specific employee wage and hour guidance. Pay close attention to workplace issues that could lead to wage and hour complaints.

- Review any state-specific legislation related to marijuana legalization. Consider revising procedures related to conducting workplace drug tests for marijuana or basing employment decisions on an employee’s marijuana usage, as these practices could potentially contribute to EPL claims.

General Liability Insurance

In recent years, the general liability market has consistently underperformed for insurance carriers. As claims have increased in frequency and severity, insurance carriers have responded by tightening underwriting standards, deploying less capacity and seeking rate increases. Despite recent trends, carriers have begun to see modest improvement in general liability results.

In 2022, we predict that most policyholders will encounter another year of modest rate increases for general liability coverage. Renewal results will likely depend on an organization’s exposures, class and loss history. Policyholders who operate in sectors with elevated general liability exposures (e.g., real estate, construction, manufacturing, retail, hospitality and contracting) may be more prone to double-digit rate increases and increasingly restrictive underwriting standards, as well as experience significant difficulties securing or maintaining higher coverage limits.

Developments and Trends to Watch

- Social inflation concerns—Put simply, social inflation refers to the heightened frequency and severity of insurance claims. These rising costs are the result of societal trends and views toward increased litigation, broader contract interpretations, plaintiff-friendly legal decisions and large jury awards. Together, these factors can raise the cost of insurance. Currently, the primary factor influencing social inflation within the liability market is nuclear verdicts—especially in the case of commercial auto accidents and class action lawsuits. According to the latest data from industry experts, these trends have contributed to a more than 300% increase in the median value of major U.S. verdicts since 2014.

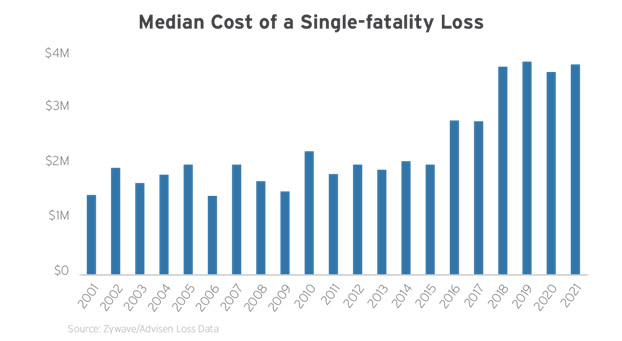

- Surging single-fatality expenses—Single-fatality losses have become an increasingly prevalent concern within the liability insurance space over the past decade. Such losses can stem from various scenarios (e.g., on-site accidents, product defects and commercial auto crashes) in which organizations are held liable for the resulting fatalities. According to Advisen loss data, the median cost of a single-fatality loss spiked 67% between 2010 and 2020, jumping from $2.3 million to $3.7 million. Although these losses have occurred across industry lines, the manufacturing and construction sectors collectively contribute to more than one-third (35%) of overall single-fatality losses, primarily due to their high-risk operations. The increasing cost of such losses has been attributed to a rise in fatal incidents as a whole, social inflation and surging medical expenses. When single-fatality events arise, they are generally followed by wrongful death lawsuits. These lawsuits may result in a range of awarded damages—including medical costs, funeral expenses and lost wages, among others—thus leading to costly liability claims.

- COVID-19 exposures—The early days of the COVID-19 pandemic forced many businesses to temporarily close their doors to avoid threatening the health and safety of their employees and customers. Although the economy largely reopened in 2021 and many businesses resumed their typical operations, continued infection hotspots and new variants have created ongoing COVID-19 risks and subsequent liability exposures. For instance, visitors or customers who get infected with COVID-19 after visiting a business may allege that the establishment’s lacking precautionary measures or failure to follow public health guidelines contributed to their illness. As such, pandemic-related lawsuits and associated liability claims have remained an ongoing concern.

Tips for Insurance Buyers

- Work with your insurance broker to educate yourself on key market changes affecting your rates and how to respond using loss control measures.

- Ensure your establishment has measures in place to reduce the potential for customer or visitor injuries (e.g., maintaining safe walking surfaces and promoting proper housekeeping).

- Consult federal, state and local guidance to establish a safe reopening plan for your establishment with adequate COVID-19 prevention protocols.

- Reach out to your insurance broker to review pandemic-related coverage restrictions.

- Examine your general liability coverage with your insurance broker to ensure limits match up with your insurance needs.

Workers’ Compensation Insurance

Unlike other commercial insurance coverages, the market for workers’ compensation insurance has remained stable across most states and industries, performing as an outlier by producing profitable underwriting results. According to the National Council on Compensation Insurance (NCCI), the private carrier combined ratio for workers’ compensation in 2020 carriers was 87, up from 85 in 2019, marking the seventh consecutive year of underwriting profit.

Because the COVID-19 pandemic resulted in many organizations transitioning to remote work operations, many employees across industry lines have been less prone to illness and injury within their work-from-home arrangements. In fact, despite initial concerns about the COVID-19 pandemic, workers’ compensation losses do not appear to have been materially affected by the pandemic. Further, the emergence of telemedicine has helped many organizations supply more immediate and cost-effective treatment options for any employees that get injured on the job—thus providing the potential to minimize workers’ compensation claim costs.

Nevertheless, there are still trends that could pose concerns within the market for 2022. Various workforce trends—including a rise in comorbidities, labor shortages and an aging population—are also expected to impact workplace injuries and illnesses and subsequent claims. For 2022, we predict that workers’ compensation rates will remain stable, with some organizations experiencing rate decreases and others seeing minimal rate increases.